oregon workers benefit fund tax rate

This tax rate is the same for all. The 22 cents-per-hour rate is the employer and worker rate combined.

Workers Comp Or Disability Which Is Better Kbg Injury Law

NE Salem Oregon 97301.

. The assessment is paid directly to Oregons Employment and Revenue departments through quarterly payroll tax reports and the revenue is transferred. Ad Affordable Easy To Understand Workmans Comp Insurance. WBF delivers high-value group benefits to gig workers.

10 2021 142 PM. Tri-County Metropolitan Transportation District TriMet tax rate is. The pure premium rate decrease is effective January 1 2020 but employers will see the changes when they renew their policies in 2020.

22 cents per hour worked. 3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour. Wwwdcbsoregongov Testimony of DCBS Director Our Mission.

Tax rates The Workers Benefit Fund WBF assessment rate. Get Quote Buy Instantly Online. Systematic Benefit Solutions for Gig Workers.

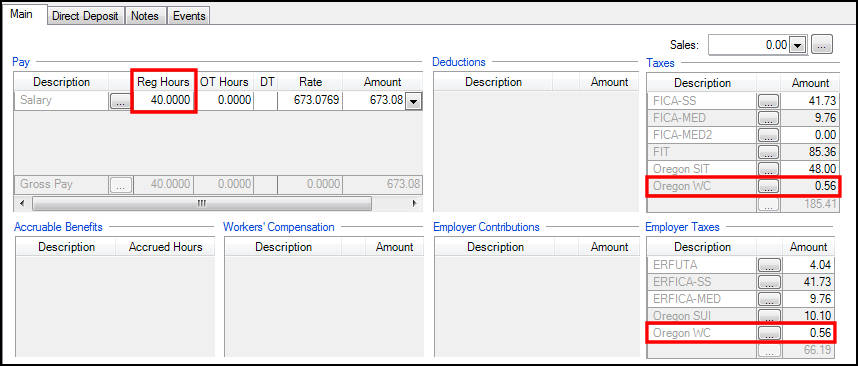

By Jazlyn Williams. It is automatically added by payroll but requires a manual entry of the workers assessment rate for each employee and company rate. The rate is unchanged from 2021.

Statewide Transit tax STT rate is. Your Workers Compensation Policy Will Be Ready In Less Than 10 Min. Lane Transit District LTD tax rate is 00077.

Workers compensation rate information. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to.

The combination of the changes to all of the workers compensation rates for 2020 will result in the average employer paying 102 per 100 of payroll for claims costs and assessments down from 111 for 2019. Employers and employees split this assessment. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year.

Tax Formula Set Up. Ombuds Office for Oregon Workers 800-927-1271. As independent contractors gig workers lack access to a stable benefits package.

General Oregon payroll tax rate information. You are required to report and pay the WBF assessment if 1 you have workers for whom you are required by Oregon law to provide workers compensation insurance coverage. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment.

16 at 3 pm. For information about calculating the assessment visit oregongovDCBSPages. Go online at httpswww.

Oregon Workers Benefit Fund Payroll Tax Overview. The taxable wage base for Unemployment Insurance UI is 47700. The Oregon statewide transit tax rate remains at 01 in 2022.

The workers benefit fund assessment rate is to be 22 cents per hour in 2022. Employers are required to pay at least 11 cents per hour. Employers contribute not less than half of the hourly assessment 11 cents per hour and deduct not.

The funds revenue comes from a cents-per-hour-worked assessment. You are responsible for any necessary changes to this rate. Workers Benefit Fund Payroll assessment Special benefits for certain injured workers and their families and return-to-work programs.

2 you choose to provide workers. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to families of workers who die from workplace injuries or diseases. The purpose of the tax is to help fund programs in Oregon to help injured workers and their families.

Oregon Workers Benefit Fund. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. These programs help keep Oregons workers compensation costs low.

Employers use Forms OQ and OTC to report and pay the assessment through Oregons Combined Payroll Tax Reporting System. The WBF assessment rate. These coronavirus stimulus checks from Oregon however would go only to low-income workers.

If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under workers comp. On Tuesday House Democrats in Oregon reintroduced a bill to give a one-time payment of 600. Workers Benefit Fund WBF Assessment Definition.

Workers Benefit Fund works with platforms labor unions and policy leaders to provide health and other benefits to millions of workers in todays rapidly. The Oregon workers compensation payroll assessment rate is not to change in 2022 the state Department of Consumer and Business Services said Sept. Employers and employees split the cost.

Virtual public hearing set for Thursday Sept. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation insurance in Oregon and by all workers subject to Oregons Workers Compensation Laws whether or not covered by workers compensation insurance. To protect and serve Oregons consumers and workers while supporting a positive business climate Workers Benefit Fund Assessment Rate Andrew Stolfi September 16 2021 The Workers Benefit Fund WBF assessment provides benefit increases to permanently disabled.

The Oregon Worker Benefit Fund OR WBF is an hourly tracked other tax that is different from Oregon Workers Compensation. 653026 Nonurban county defined for ORS 653025. For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022.

Employers and workers each pay half of the assessment. Line 10 of the formula can be set up one of two ways depending on how your company decides to handle the tax. Employers and employees split the cost evenly.

The state transit tax. The Workers Benefit Fund WBF assessment this is a payroll assessment calculated on the basis of hours worked by all paid workers owners and officers covered by workers compensation insurance in Oregon and by all workers subject to Oregons Workers Compensation Laws whether or not covered by workers.

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

More Companies Are Wooing Workers By Paying Off Student Debt Money

How Much Is Workers Compensation Insurance In Ny

Are Workers Compensation Settlements Taxable

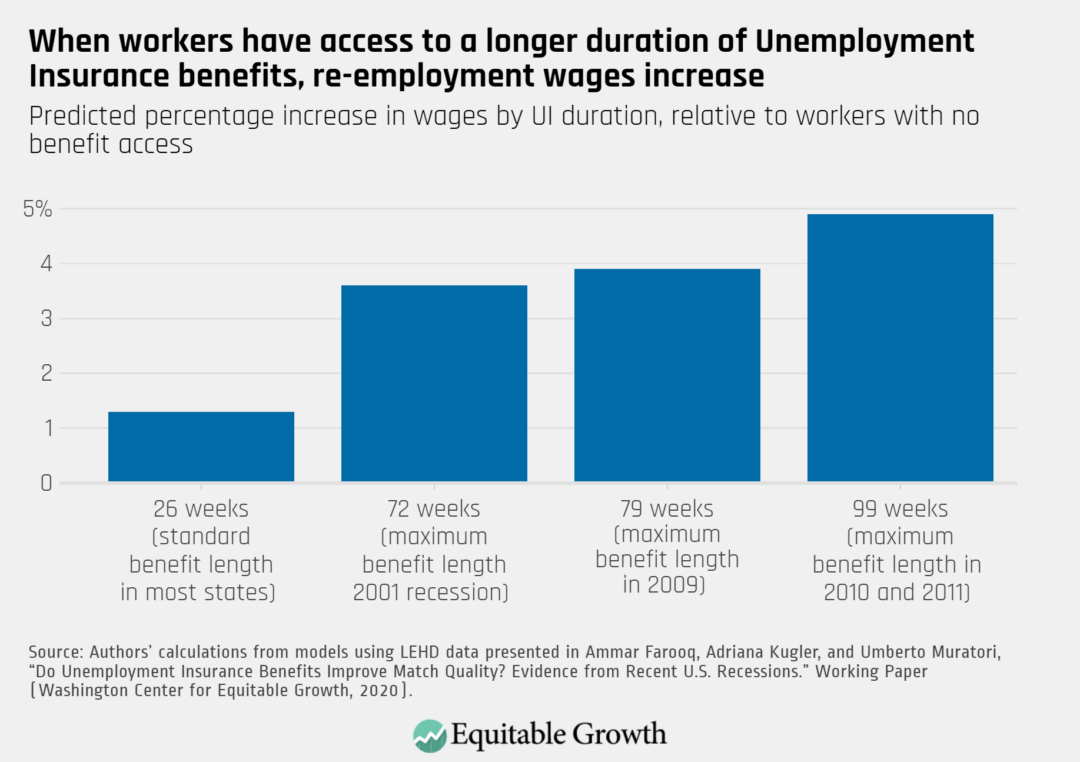

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Oregon Workers Compensation Division Order Compliance Poster Employer State Of Oregon

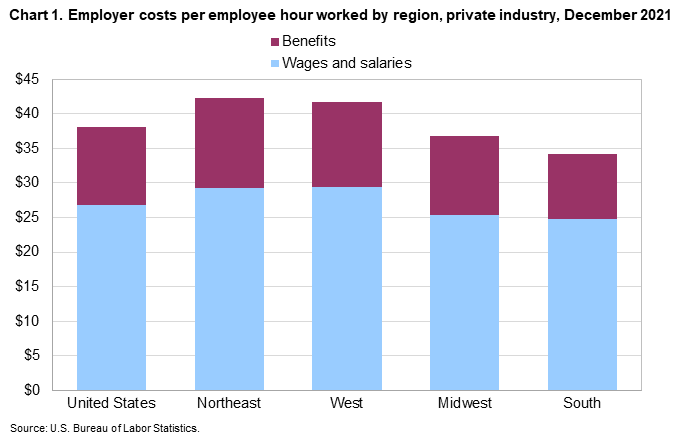

Employer Costs For Employee Compensation For The Regions December 2021 Southwest Information Office U S Bureau Of Labor Statistics

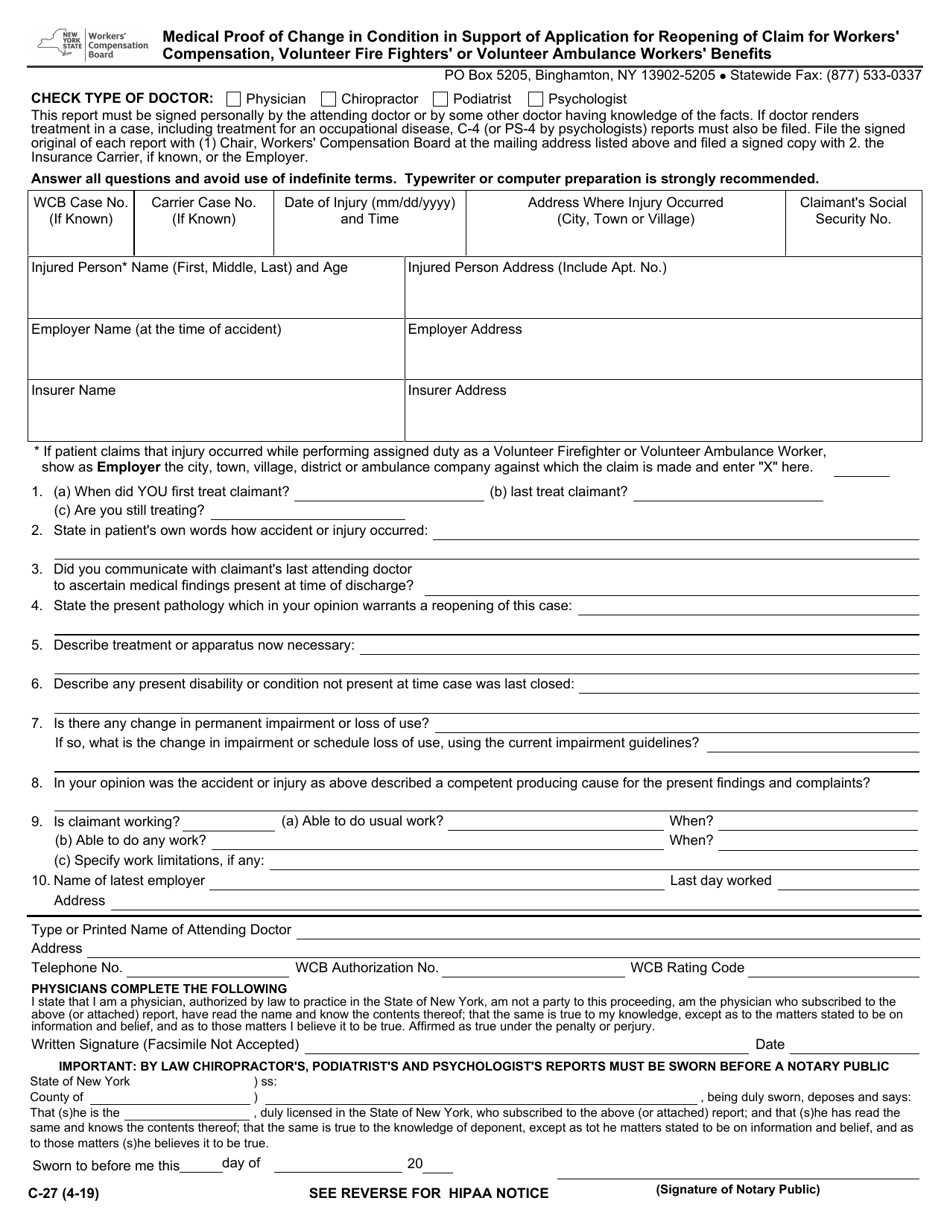

Form C 27 Download Fillable Pdf Or Fill Online Medical Proof Of Change In Condition In Support Of Application For Reopening Of Claim For Workers Compensation Volunteer Fire Fighters Or Volunteer Ambulance Workers

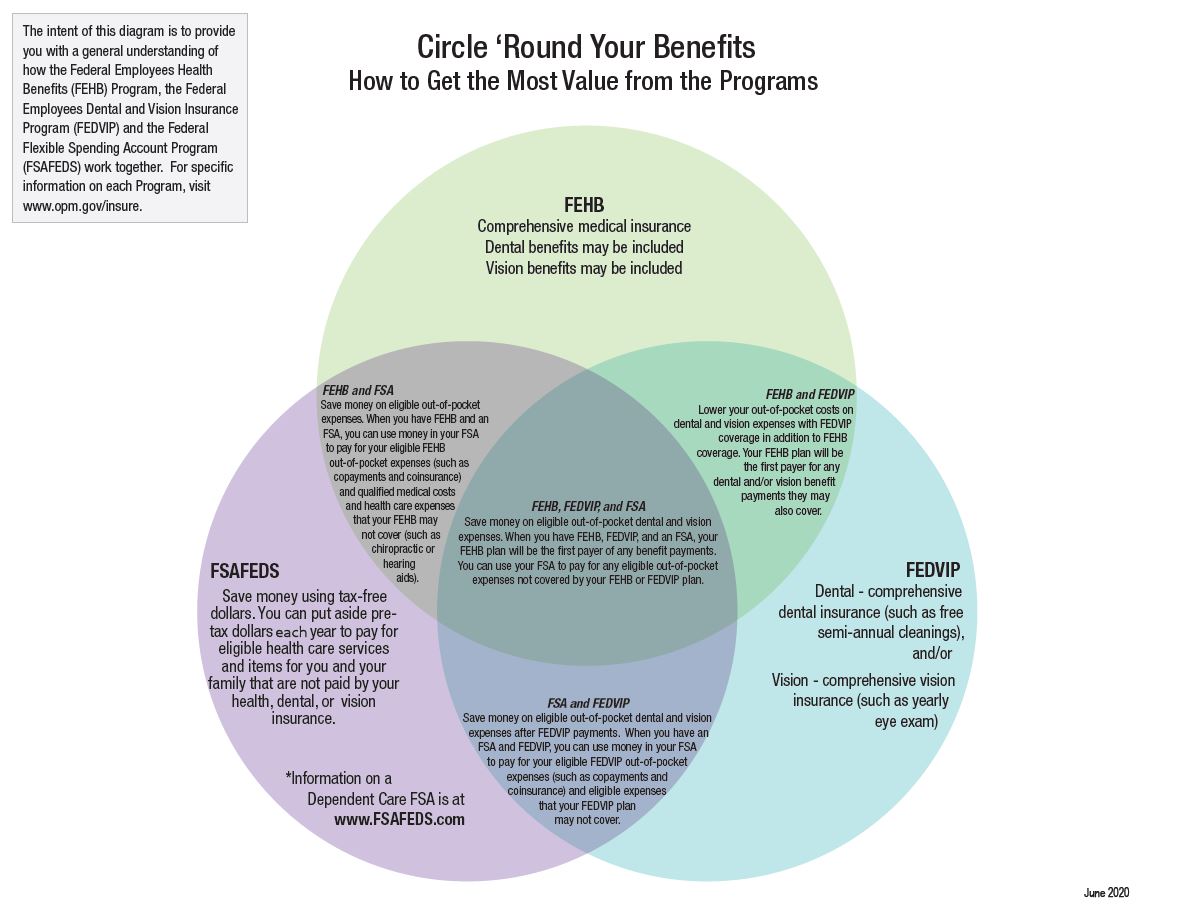

Raising Pay And Providing Benefits For Workers In A Disruptive Economy Center For American Progress

Employee Benefits Pay U S Department Of The Interior

Is Workers Comp Taxable Workers Comp Taxes

What Wages Are Subject To Workers Comp Hourly Inc

Pin On Legalshield Independent Associate

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon